Insight

Cultural Themes

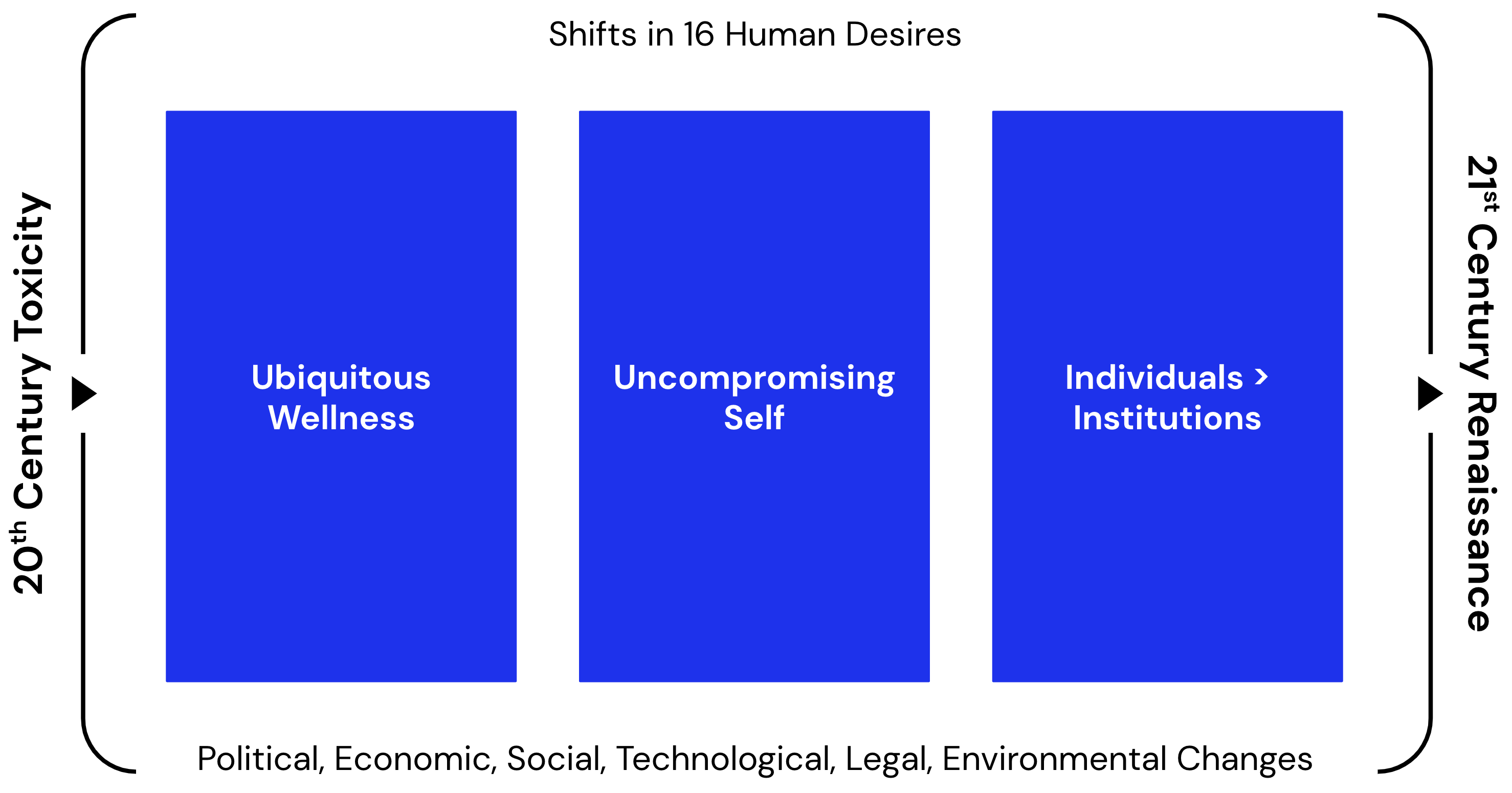

While a very vocal majority of venture capital tends to fixate on technological advances, product-centricity and a build-it-and-they-will-come mentality; Bullish roots itself in cultural desire, consumer-centricity and and a skate-to-where-the-puck-is-going approach to funding new ideas. And as such, we place great importance on understanding the constantly evolving nature of the 332 million people living in the United States.

Having been early backers in forward-thinking consumer companies like Peloton, Warby Parker, Harry’s, Sunday Lawn, KiwiCo, Casper and 40+ others, our decade of demand-side biased investing is fueled by a careful attention to the human desires that a given Startup’s proposition is solving for.

We are sharing a look into our approach through the publication of our investing themes in a paper we produced called: Bullish on Consumer: Operationalizing Demand-Side Themes for Better Outcomes. These themes are based on a significant body of expertise and experience:

Surveys of 7,500+ people across America

1,200+ hours of interviews and/or ethnographies with people face-to-face

Reviews of over 12,500+ early-stage consumer businesses

Consulting engagements with 20+ Fortune 500 companies

5 years of data on human desire and category spend from our Power of Why study

First hand experience(s) from 20+ years working across 200+ consumer categories

It is important to note that while we believe in certain consumer-based truths, change is constant. Given our active and ongoing consumer research and data collection from over 50+ portfolio companies, our strength resides less in the timelessness of our thoughts, and more in our proven ability to identify how they may change.

Download Bullish on Consumer: Operationalizing Demand-Side Themes for Better Outcomes below.

More

News

Bullish on Cob Foods, our latest investmentInsights

Data Rich, Direction PoorInsights

Pioneers Mid-Year Sentiments 2025Insights

2025 Bullish Consumer/LP Summit HighlightsNews

Mike Duda featured in Beauty IndependentInsights

The Postzempic EconomySign up for the latest consumer insights and news

Most Dangerous Agency in America™

©2025