Insight

How consumer sectors will feel macroeconomic moves

2023 was a turbulent year for the U.S. economy. Rising interest rates designed to combat inflation sparked trepidation among economists and investors of a potential recession. That sentiment, combined with the rising cost of capital, slowed business and investing activity. Meanwhile, consumer spending stayed strong and unemployment rates low.

As consumer investors, we operate in a world where the macroeconomic climate has a direct impact on consumer behavior and spending. While we spend a lot of time studying and tracking cultural themes and human behavior, we also keep an eye on changes in private capital markets, governmental policy, and technology that have the potential to impact future consumer demand.

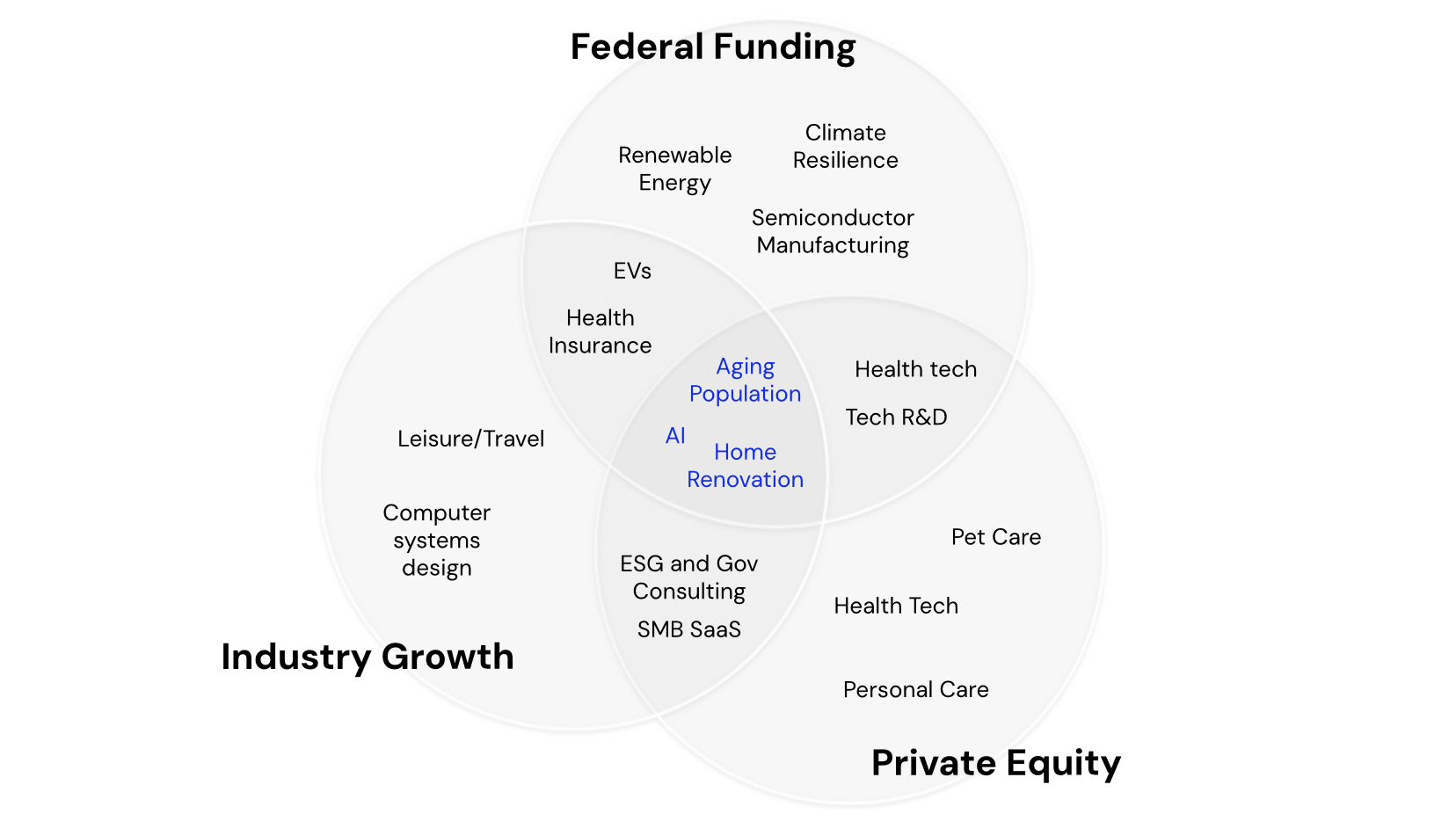

To get a better handle on the macro environment as we kick off a new year, we reviewed federal funding initiatives, growth-stage and private equity patterns, and labor market reports from 2023.

We found that 2023 saw significant investment into the supply-side of certain consumer categories. In these spaces, the infrastructure created today will lay the foundation for inevitable consumer applications.

Federal Funding

The federal government pumped an extraordinary amount of capital into the economy in 2023, primarily through the Inflation Reduction Act (IRA). Passed by President Biden in 2022, the IRA outlined $500 billion in spending and tax breaks to address economic and environmental challenges. Celebrated as “the largest investment in clean energy and climate action ever,” the Act aimed to combat inflation, incentivize domestic energy production, and reduce carbon emissions 40% by 2030.

IRA funding has already started to incentivize innovation in climate tech and healthcare. Both sectors are ripe for disruption from a consumer perspective; Americans are seeking more sustainable lifestyle solutions and access to high-quality, holistic care. But both also need considerable technological advancements in order to accommodate consumer price sensitivity and prioritization of convenience.

Clean Energy

Tax Breaks for Renewable Energy: The IRA extended the Production Tax Credit and Investment Tax Credit through 2024, both of which have benefitted wind and solar industries.

Grant Funding for Clean Energy Transition Projects: The Act gave the EPA $27 billion to award grants to states, municipalities, and nonprofits for clean energy and climate projects, with emphasis on projects that benefit low-income and disadvantaged communities.

Private Sector Incentives: In the IRA’s first year, the private sector announced over $110 billion in clean energy manufacturing investments, including over $70 billion towards the electric vehicle supply chain and $10 billion towards solar manufacturing.

Healthcare

Health Insurance: The IRA extended Affordable Care Act tax credits, which subsidize health insurance premiums for Americans near the federal poverty level to ensure that no one spends more than 8.5% of income on health insurance premiums.

Drug Price Controls: Starting in 2026, Medicare will be able to negotiate prices with biotech and pharma companies. The change is projected to result in an 8% drop in earnings for those companies in the first 10 years.

In addition to the IRA, the 2022 CHIPS and Science Act authorized a significant increase in funding for technology R&D and manufacturing. The Act allocated just over $52 billion to the domestic development and manufacturing of semiconductors and outlined further investment into researching and developing cutting edge technologies (quantum computing, AI, clean energy, and nanotechnology).

Private Equity and Growth Capital

2023 marked a significant decline in private equity deal activity, with global private equity and venture capital deal value and volume reaching their lowest levels in at least five years. The first half of the year saw a 58% decline in buyout funds' deal value compared to the same period the previous year, but deal activity started to accelerate in the third quarter as firms gained greater visibility into interest rate trajectories and macroeconomic conditions.

We looked at the deal activity of leading PE firms (especially those that invest in consumer sectors) to identify the categories that saw significant investment despite the slow 2023 market. These investment choices represent the areas equipped to either weather market fluctuations or support eventual consumer demand. We found that these firms continued to invest in emerging technologies, healthcare, professional services, and recession-proof consumer categories.

As expected, AI was a particularly popular segment as companies emerged to both support AI development and apply the technology across industries. Healthcare investments continued to decline following a 2021 peak, but comprised a significant portion of deal activity among consumer firms. Twenty-seven percent of PE funding went to services companies in H1 2023 - the acquisition of Guidehouse by Bain Capital and Anthesis by Carlyle are great examples.

Meanwhile, consumer-focused firms continued to invest in brands, but took a more risk-averse approach. Recession-proof industries like pet care saw considerable investment; General Atlantic invested in Village Pet Care, and co-led an investment with L Catterton into Butternut Box (European pet food company). Apparel and restaurant companies that were able to secure investment were generally larger consortiums of brands, such as Authentic Brands Group or Suave.

Industry Growth

While slightly different from the other factors considered, labor trends provide insight into the realized implications of both funding allocations and consumer demand. Labor reports can be helpful indicators of actual industry growth.

The labor market ended 2023 with a strong finish, adding 216,000 jobs in December, and the unemployment rate remained below 4%. In terms of industry-specific trends, employment in government, health care, and construction saw notable gains. An average of 56,000 government jobs were added per month in 2023, compared to 23,000 the previous year. The healthcare sector added an average of 55,000 jobs each month in 2023, compared to an average of 46,000 in 2022. Interestingly, the leisure and hospitality industry also saw continued growth in 2023, although at a slower rate than in 2022.

Job gains in consumer sectors underscore the economic resilience of and potential for growth in these categories, even if most of that movement is currently happening behind the scenes.

So, where’s the money going?

In the U.S., we are - right now - building the infrastructure to support an AI revolution, to produce renewable energy, and to support the health and welfare of an aging population through supply side investment. Given public and private funding patterns and early industry indicators, we expect to see consumer implications roll out in the coming years in the following sectors:

Consumer sectors

Elderly support: The U.S. population age 65 and over grew 38.6% from 2010-2020 to 55.8 million. Private capital markets are fueling the development of healthcare technologies and infrastructure, and the IRA allocated significant funding to support this population. Policy around drug pricing and insurance premiums will give elderly Americans more spending power, not just for health expenses but also overall quality of life. Given the thriving leisure economy and the general consumer investment in experiences, we’ll likely see an evolution in retirement lifestyle solutions.

Artificial Intelligence: The private capital markets slowed in 2023, but investment in AI soared as federal initiatives allocated funding to tech R&D and domestic manufacturing. AI-related startup investments surpassed $23 billion in 2023, with a notable focus on generative AI solutions. We’re just beginning to see consumer applications of AI, but expect to see more as the backend infrastructure is bolstered and technology improves.

Home Renovation: The IRA includes several tax rebates for individuals to make eco-friendly improvements to their homes (stoves, heating systems, etc.). High interest rates and a challenging housing market will likely cause Americans to move less, and instead invest in improving their current homes.

For more consumer insights from Bullish, subscribe to The Brief and follow us on LinkedIn.

More

Insights

Pioneers Mid-Year Sentiments 2025Insights

2025 Bullish Consumer/LP Summit HighlightsNews

Mike Duda featured in Beauty IndependentInsights

The Postzempic EconomyInsights

Cultural Tension: There’s no I in TEAM, there's MEInsights

Atomization of AttentionSign up for the latest consumer insights and news

Most Dangerous Agency in America™

©2025